Setting Up US Sales Tax Collection on Amazon Seller Central | The Ultimate Guide

![[object Object]](/static/me-23049605cef09a4fa7f368081ea6894a.jpg)

Michael Schwartz

The repercussions of violating any tax code related to the Amazon seller's business befalls only the seller, with Amazon completely exonerated. It, therefore, goes without saying that every Amazon seller is responsible for the local tax nexus applicable to their Amazon business.

The Essentials for the Setting Up of the Sales Collection Program on Amazon Seller Central

The following are essentials that must be put in place before setting up a sales tax collection program on Amazon seller central:

- An Amazon Professional Sellers Account: The sales tax collection program is not available to individual account holders.

- Details of tax nexus applicable to the state which hosts the physical presence of the business.

- The seller tax ID number and registration details: The seller tax ID must pertain to the state in which you obtained sales tax paperwork and which also ties your business to a sales tax nexus.

How To Register For the Sales Tax Processing Program on Amazon Seller Central

Step 1: Log in to Amazon Seller Central with your credentials.

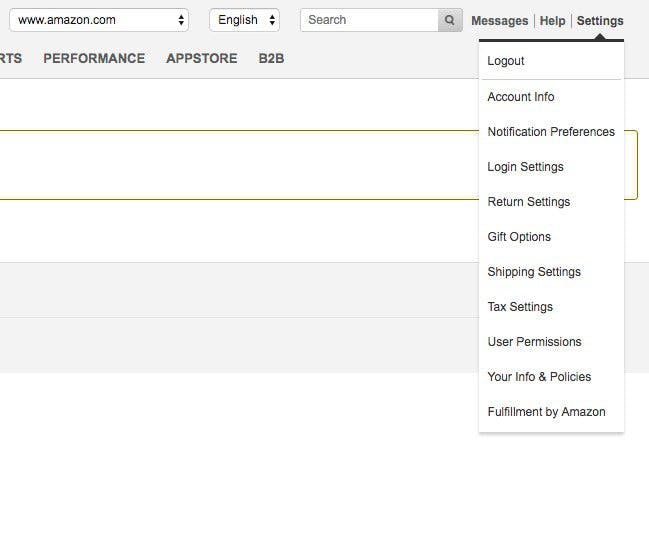

Step 2: Select "Tax settings" from the Settings drop-down menu.

On this page, you'll find a comprehensive guide to setting up the sales tax collection program, as well as some vital information such as the tax codes for specific products.

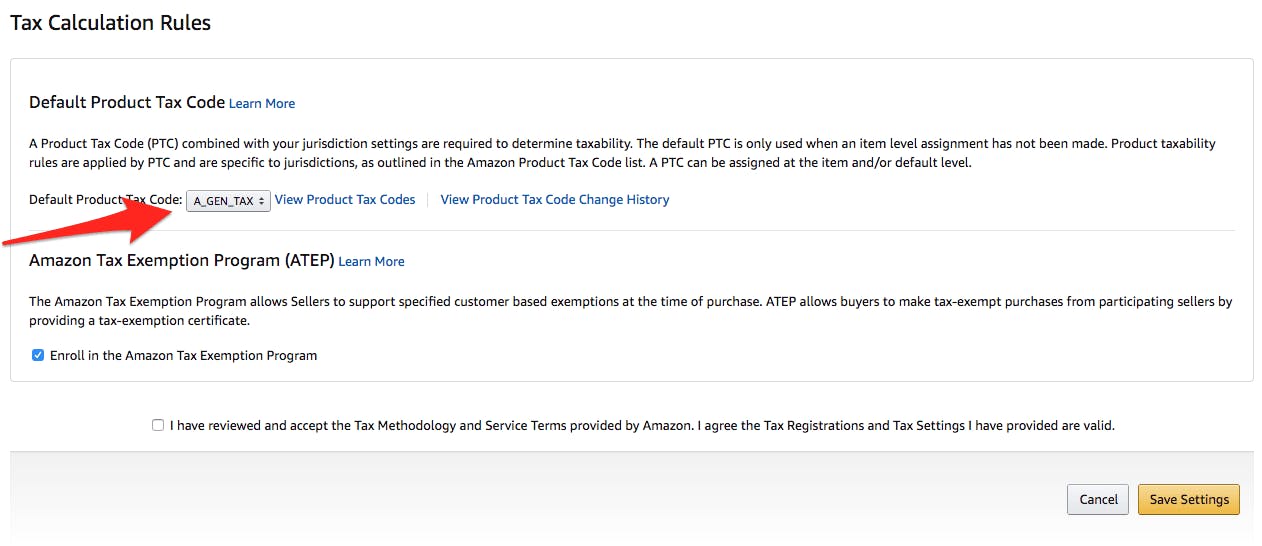

Step 3: Tax Settings

The first time you visit Tax Settings, you may need to accept Amazon's terms and conditions. First, scroll down to Tax Calculation Rules to select the product Product Tax Codes.

Step 4: Product Tax Codes

Click View Product Tax Codes to determine whether your sales categories do not have a specific product tax code.

States charge sales tax on products that other States don’t. Take your time to set up the collection correctly.

Step 5: Determine Nexus

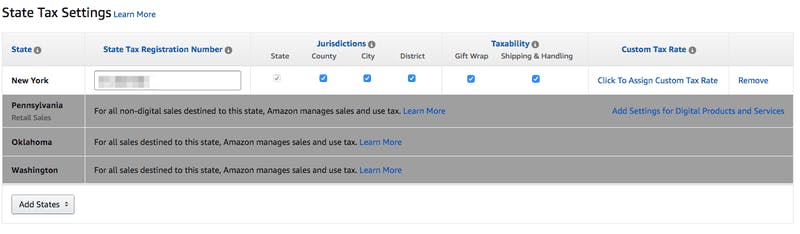

Choose the state and city or county in which you have a sales tax nexus. You are also required to enter your valid state registration number for you to be able to save the state.

You can also customize how you would like Amazon to collect Sales Tax for each state you add.

Step 6: Verify Product Tax Code

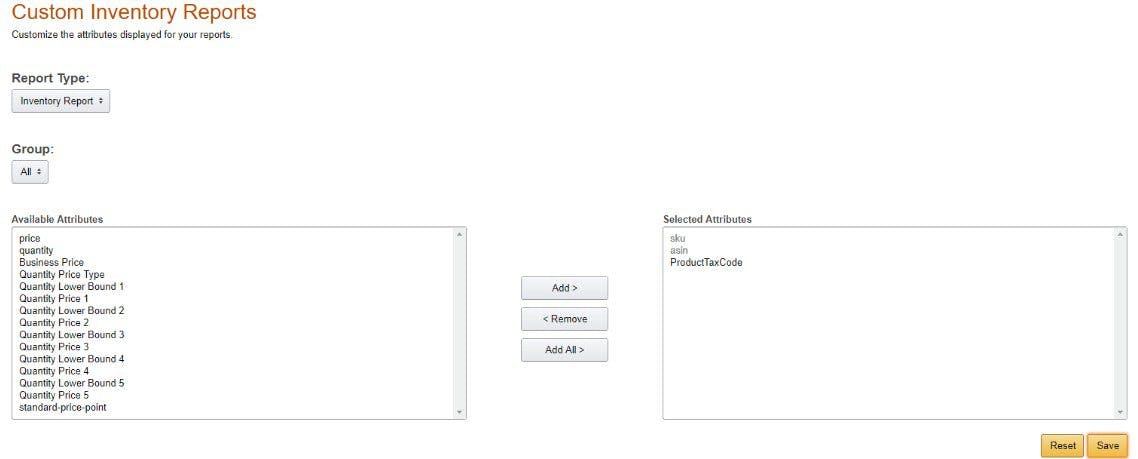

To check whether you have chosen to correct Product Tax Code go to:

Inventory > Inventory Reports > Customize the Columns and add the following columns to the right side (e.g., SKU, ASIN, and Product Tax Code)

After requesting and downloading the report, you can see if you missed any of the Product Tax Codes.

To fix any of the missing products. Go to:

Inventory > Edit > Offer Tab

That's it!!!

You can set your focus on other aspects of your business and not break a sweat over your sales taxes.

Remember Amazon ONLY collects Sales Tax in certain states where marketplace facilitator laws are in place, they do not always pay your Sales Tax on your behalf.

Additional Info About Sales Tax on Amazon

Amazon faces tax impositions for the products it sells to consumers across states. But this is not to be confused with the tax imposed on third-party sellers.

The onus of identifying tax nexus applicable to the geographic situation of a third party seller rests on the individual Amazon seller. However, Amazon offers to assist individual sellers in collecting their sales taxes for every sale generated on the Amazon marketplace, as long as the individual sellers supply details pertaining to the relevant tax nexus.

Amazon's tax services are a great alternative for sellers who're wary of the hassles associated with paying taxes out of a personal purse.

The Pitfalls Associated With The Collection of Sales Tax on Amazon Seller Central

Why do so many Amazon sellers flounder in their sales tax management?

For starters, given the nature of the Amazon FBA, the setting up of an FBA business calls into effect sales tax nexus pertaining to multiple states.

Due to a lack of proper tax advice, many Amazon sellers are always confronted with several sales tax liabilities. However, since many individual states do not make thorough audits of Amazon seller's tax returns, these violations just slide by, but nonetheless, remain as pending sales tax liabilities that keep accumulating.

Tax returns are a relatively easier issue to deal with for Amazon sellers who aren't into FBA. The location of offices and warehouses is clearly known and therefore the applicable tax nexus is easily determined.

However, the set up of the tax sales collection program on Amazon is a rather rigorous affair that throws off many applicants at several points. The interface and instructions on the Amazon seller central tax settings page often come off as intricate and demanding.

Some Key Considerations Pertaining To The Collection of Sales Tax on Amazon Seller Central

1. Tax Nexus

A tax nexus is activated when a business establishes a physical outlet in any state. This is a key consideration essential for the set up of the sales tax collection program on Amazon, as well as for an eCommerce site looking to establish a physical location in any state.

The tax nexus related to an individual Amazon seller's business takes into account details such as the location of the FDA warehouse, as well as affiliates of the business domiciled in that state. Nonetheless, the services of a tax attorney cannot be recommended highly enough for the enrollment in the sales tax processing program on Amazon seller central.

Tax nexus issues are one of the most daunting challenges that Amazon sellers constantly face. Every now and then, an Amazon seller runs the risk of violating a tax nexus.

Since there's yet to be a national tax policy that caters specifically to Amazon FBA, only a few states apply stringent enforcement of the relevant regulations that could penalize these frequent tax nexus violations.

Whether you're running your Amazon business from a physical location in the US or not, you still need to treat tax nexus as a potential risk, as you can stir the pot if you rake in a certain volume of sales in any US city.

2. The Tax Collection Process:

Please Note: Amazon charges 2.9% of the gathered sales tax as service fees.

The Amazon sales tax processing program is designed to collect taxes directly from revenues generated by sellers in the Amazon marketplace, provided the sellers make available information concerning the applicable tax nexus for the particular states which host the physical presence of their Amazon business.

To initiate the program, the seller must first obtain relevant tax information including the sales tax ID number and then proceed to load the relevant details on the tax settings in Amazon Seller Central (explained in detail in the section above).

Always Be Careful!

As a result of the complexity of the setting, many users always end up forgetting to specify some vital details such as the county, city, or state where the business operates physically. Another intricate segment of the tax settings is the section that requires the seller to specify the appropriate tax code for each product being sold.

If the seller is clueless about the tax code pertaining to a particular product, there is an option that allows you to use a default tax code for a product, which is available on the Tax Manager tools page. This option allows Amazon to disregard the sales tax ID registered by the seller as we as any local tax code applicable to the product.

Amazon applies the "A_GEN_NOTAX" code to a particular product. The "A_GEN_TAX" code is the predecessor of the "A_GEN_NOTAX" code used to ensure the collection of tax on every product sale by charging a rate that is an approximation of the existing tax codes for products. This blanket code can charge tax rates that are higher or lower than the real tax rates of each product.

In order to avoid undue taxes on products being sold, it is imperative for sellers to examine the wide array of product tax codes available in the seller support guide.

So . . .

You may have got the hint that setting up Sales Tax on Amazon Seller can not only be tricky but also time-consuming and potentially, scary. If you are unsure of which option to select or just unsure of something, we highly recommend contacting your accountant for more information.

Disclaimer: The above information is made available on a good faith basis and is intended only for general education. The article should not be construed as tax or legal advice. We recommend getting in touch with a duly certified tax professional or CPA to assist with any topics raised by this article.

![[object Object]](/static/me-23049605cef09a4fa7f368081ea6894a.jpg)