What is Shopify Payments?

Shopify Payments is Shopify’s built-in payment provider with Stripe as the backbone. If you enable Shopify Payments, Shopify will automatically pay you when a customer pays using Shopify payouts and other payment systems.

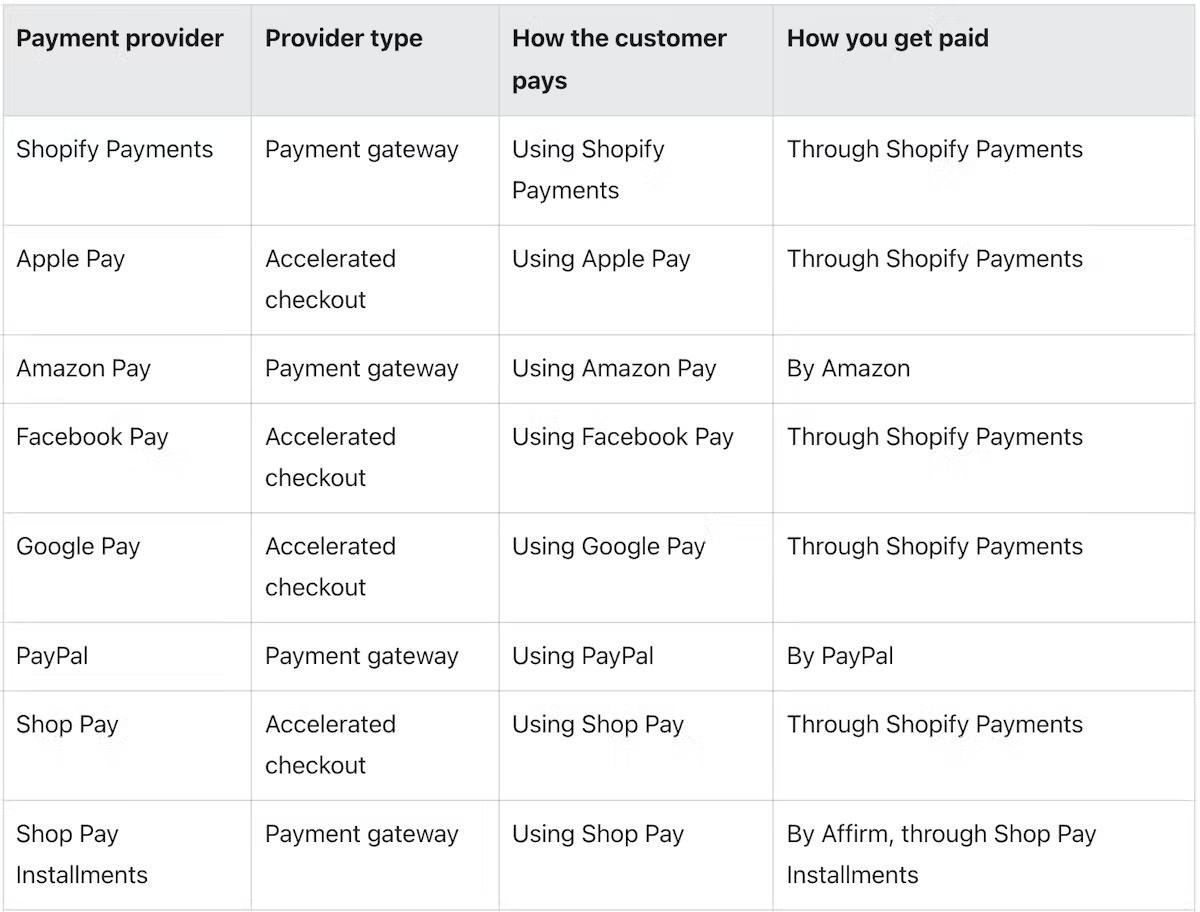

For example, if the buyer pays a Credit Card using Shopify Payments, you will receive a payout directly from Shopify. If the buyer were to use Amazon Pay or Paypal you would get paid directly from Amazon or Paypal. The below chart explains how you will receive payment based on the Payment Provider the buyer uses.

See more at https://help.shopify.com/en/manual/payments/getting-paid

What is Shop Pay?

Shop Pay is an accelerated checkout where buyers can save their email address, credit card, and billing information so they can complete their transactions faster when using Shopify checkout. After registering for Shop Pay buyers only need to enter their email when using Shopify checkout. Shop Pay also allows you to offer customers the option to pay for their purchases in installments.

Shop Pay is not the same as Shopify Payments.

Shopify Payments is the payment system built by Shopify to accept credit cards, Apple Pay, Google Pay, Shop Pay, and others and pay you on a regular basis. Shop Pay is the option from Shopify during the checkout to save payment information for future purchases across the Shopify ecosystem.

Benefits of Using Shopify Payments

You may be wondering whether it is worth it to use. Here are the reasons for using Shopify Payments:

Payment Options: Shopify Payments allows your buyers to use a numbering of payment methods: Amex, Visa, Mastercard, Facebook Pay, and Google Pay.

Seamless Integration: Since Shopify Payments are part of the Shopify ecosystem they integrate seamlessly and create a simple experience for the buyer.

Lower Fees: Shopify charges you for external gateway providers (e.g., PayPal, Amazon) on top the what the external gateway charges.

Flexible Payment: Buyers can pay using Shop Pay Installments (run by Affirm).

Drawbacks of Using Shopify Payments

Payouts are Net of Fees: All fees are deducted from the total revenue, which makes keeping proper books and records difficult.

Chargeback Fees: Shopify will charge you $15 for any chargeback.

Not available in every country: Check here to see if Shopify Payments is available in your country.

Held Payments: Like most payment systems, Shopify can hold the payout of your funds at its discretion, as well as suspend your use of its payment services.

Best Way to Keep Proper Accounting Records

Shopify payouts are net of any fees you owe Shopify. This means that your revenue is higher than what you will receive as a payment in your bank account.

It also makes keeping any accounting records difficult. In order to have proper books and records, you will need to separate your sales, refunds, and fees.

To properly account for refunds, sales, and fees reducing your payouts, you need to “gross up” the transaction. To do this you take the payout and increase it to reflect the sales and deduct the expense on the other side of the accounting entry.

If this is confusing, don’t sweat! Let us handle any integration between Shopify and your accounting software.

Taxomate connects Shopify to QuickBooks Online and Xero Accounting. We take the guesswork out of Shopify Accounting by allowing you to automate the process and send single entries or invoices to your accounting software so you have accurate books and records.

Additional Information on Shopify Payments

How often do you get paid using Shopify Payments?

You can check your pay period to see when you receive payouts from credit card orders.

The length of your pay period is based on the country where your store is based. If you use a payment schedule, then your pay period is adjusted according to the schedule that you set.

After the payout is sent by Shopify, it may take a few days to be deposited in your bank.

For Shop Pay Installments, you will receive the full amount for the order within 1 to 3 business days of the order and you will not have to wait until the buyer makes all payments.

Does Shopify Payments work with multiple currencies?

Yes, Shopify Payments comes with support for multiple currencies. You can see the full list here.

How long does it take for a customer to be refunded?

Approximately 5–10 business days.

Shopify Payments – Takeaways

Shopify Payments is a convenient way to process payments without having to worry about fraud or security.

Shopify Payments is Shopify’s built-in payment provider with Stripe as the backbone.

If you enable Shopify Payments, Shopify will automatically pay you when a customer pays using Shopify.

This service eliminates the need for setup, fraud monitoring, and can eliminate fraud altogether if you use it correctly.