Amazon entrepreneurs focus mostly on finding exciting new product niches, sourcing inventory, making sure their listings are visible and useful, and of course, daily sales. Interestingly enough, when you start to talk to them about equally essential topics like managing their assets, taxes, and how to come up with a balance sheet, most sellers, even the veterans, can’t give you a straight answer.

Too many of them blank out. This is very understandable because most Amazon entrepreneurs focus primarily on getting sales. In fact, this is the secret to their success.

They spend most of their attention and resources on optimizing the operations end of their Amazon business. After all, if you know your way around the FBA program, it’s easier to log into Amazon’s system and look up business reports to check your sales statistics.

The bottom line is if you build your Amazon business on these bedrock skills, you will run a tighter ship. In fact, you might get so good at sizing up the income or loss potential of new products, that you can end up taking your business’ profitability to the next level.

There are two vital financial reports you should pay attention to. You have to become familiar with these reports because these give you a clear indication of the health of your business - your balance sheet and profit and loss statement.

Let’s get rolling …

P&L Statement: Your Business’ Performance Evaluation

Before you started your business, you probably had performance evaluations at work. These evaluations are not a waste of time. The human resources person speaking to you about these evaluations is not just socializing with you.

They’re letting you, in no uncertain terms, where you stand with the company. These performance evaluations give you a clear roadmap of your strengths as well as your areas for improvement.

You can choose to blow these off and get few to no raises or promotions, or you can choose to give them the importance that they deserve and use them to get ahead in the company. It’s your choice.

The same applies to your profit and loss statement. This seemingly simple document gives you a big picture view of your company.

It gives you your net income, which business people call “the bottom line— are you making money, or not?” For Amazon entrepreneurs, this document is one of the most essential pieces of equipment you can use to get a clear understanding of how well your business is performing.

You can calculate net income by summing up all the expenses that you have like inventory storage, pay-per-click, ad campaigns, and other costs. Once you’ve summed them up, you deduct them from your business’s total revenue. Whatever is left is your net income.

However, don’t get excited yet. You still going to have to pay taxes on the amount. Your profit and loss statement might seem relatively straightforward.

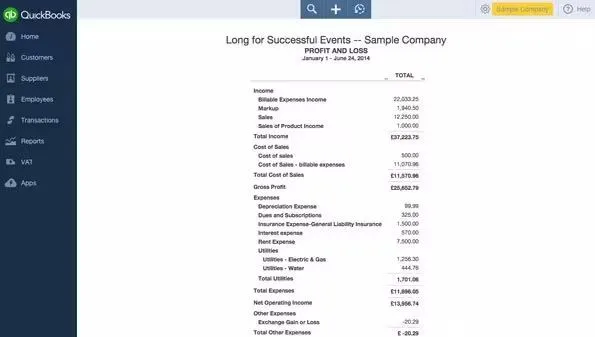

It may seem like it’s easy to calculate, but automating this while making sure that the figure is accurate is quite tricky. taxomate software enables you to import important information from your Amazon dashboard, export the data to QuickBooks or Xero, and quickly create profit and loss statements.

Profit and Loss Statement Overview

Revenue, Revenue, Revenue

At the very top of all profit and loss statements is a line called “revenue.” By downloading this information to your profit and loss statement from Amazon, you can easily see how much your business grew.

This is exciting stuff, but you also have to understand that this affects how much inventory you have on hand. It’s easy to get excited about moving to a lot of products. However, if you don’t make sure that your inventory stock keeps up, you can kiss that revenue growth goodbye

Your sales are going to hit a wall!

When you look at your profit and loss statement, you get a clear indication not just of the money that you make, but demand levels

You should then take this information and use it to decide whether it’s time to get more inventory from your suppliers. If revenue is ramping up very quickly, you better have a lot of stock on hand so you can fully take advantage of your increase in sales.

You’re going to get caught by surprise because your sales ramped up quickly but you also quickly ran out of inventory. Waiting for your inventory to be restocked is going to be brutal on your business.

Return Rate – What to Look For

Another critical factor you should consider is the return rate. If you notice that month after month you get 6% returns, this tells you two things.

First of all, it’s not high enough for you to possibly switch suppliers or make some drastic changes. Second, it also tells you that when you order stock for a given month, you should pay your order by 6%.

This way, you anticipate 5% of sales refunded. It enables you to meet all targets without a 6% shortfall.

Revenue Growth vs. Expenses – A Telling Signal

Another critical lesson you can get when looking at your profit and loss statement is comparing the growth of your expenses with the growth of your revenue. With taxomate and QuickBooks software, this is very easy to see. Simply import your summaries into taxomate from Amazon, send them to QuickBooks Online, and run a Profit and Loss Statement.

This is a dangerous sign for many businesses. Their high revenue growth might blind them to the fact that their expenses are increasing at a much higher rate than their revenue growth. The problem is they find this out too late, and they end up losing a lot of money.

The problem usually lies in advertising. If you’re paying for per-click ads on Amazon, this can be an issue – as your revenue grows, you might be paying more for advertising.

Comparing these two items’ growth curves is very important. By doing this, you’ll be able to make informed decisions about a particular product line.

If it proves to be too expensive to promote on a sustainable level, you might want to switch to another inventory or another brand. If you’re able to maintain a healthy proportion between revenue and expense growth, you might want to stick to what you have.

Key Considerations When Setting Up P&L

If you’re using automated software for P&L accounting, such as taxomate, you have to set it up right. There are two methods you can choose from - accrual basis and cash basis. They both determine revenue, but they differ based on timing.

How Cash Basis Works

For cash basis in the profit and loss statement calculation method, you report revenues when you receive cash.

**The Good Ol’ **Accrual method

This method’s revenues are reflected in your profit and loss statement when you earn the sale. In other words, the entry is recorded when the order happens, but before the customer sends the cash.

You might be thinking that this is not that big of a deal. Think again. Many businesses and accounting professionals actually prefer the accrual method. Why?

It is in line with GAAP or generally accepted accounting principles. Many people think that it just helps you get a more accurate view of your business’s financial state.

Balance Sheet: Your business’ Health Check

While your profit and loss statement evaluates the overall performance of your business, your balance sheet helps you look at the general health of your enterprise. Most entrepreneurs stick to both the profit and loss statement as well as the balance sheet.

For most business people, these two statements take care of pretty much all their needs on a day-to-day working basis, as far as decision tools are concerned.

So, why would you need a balance sheet when you already have a profit and loss statement?

The short answer boils down to the missing pieces in your profit and loss statement. While it gives you a big picture view, that picture is not complete.

Where does the P&L fall short? It doesn’t factor in the sold inventory’s value. It also doesn’t account for money that you may have borrowed so you can afford your next delivery of inventory. Additionally, outstanding sales taxes are not factored in.

The balance sheet covers all these – inventory, loans, and sales tax.

While you may have gotten a good overview of your business with the profit and loss statement, the balance sheet pretty much fills in the rest of the picture.

Accordingly, you get a very clear snapshot of just how healthy your company is at a particular point in time. This gives you a clear indication of the financial footing of your business.

Balance Sheet – What Does It Include?

Accounting Equation

Before I jump into the internal mechanics of the balance sheet, I want to explain the concept of the “accounting equation.” This concept gives you a relatively simple method of understanding your business’s financial position plus how the different parts of your balance sheet impact each other.

Please note that your specific accounting equation depends on how you have structured your business. Assuming that your business is structured just like most Amazon businesses (as a “sole proprietorship”), here’s how the accounting equation breaks down.

Assets = Liabilities + Owner’s Equity

Assets: resources your company owns. For example, 500 tofu presses with a value of $10 each.

Liabilities: what you owe to other people or businesses. For example, $400 in sales tax you need to pay

Owner’s equity: the difference between your liabilities and assets. These two columns have to equal each other. The good news is it’s straightforward to find the value of assets and liabilities. Whatever is leftover is, of course, chalked up to the owner’s equity.

Layout: A Critical Difference Between P&L and Balance Sheet

Another critical difference between a profit and loss statement and a balance sheet involves layout. When you read a balance sheet, you’re looking at a document that has two columns. On the left side are your assets and on the right side are your liabilities and equity.

When you calculate all of these as you go down each column, their totals have to match. As its name implies, a balance sheet is all about balancing both columns

While you can use a wide variety of software tools to calculate your balance sheet, it is a relatively straightforward calculation if you have all the necessary numbers.

You need to make a column for assets and then break down these down into current assets and fixed assets. List down the assets and then, sum them up at the bottom.

On the other side, you list out your equity and liabilities. Focus first on what you know, which is your liabilities.

Look at all your costs, add them up, and then, the difference between the value of the assets and the total liabilities is the amount you’re going to assign to the owner’s equity. After you put together this reasonably straightforward document, you have everything you need to get a clear understanding of your business’s overall health and current performance.

You need these statements to make crucial decisions for your business. They can mean the difference between sticking to a losing product line and optimizing a product line that has a tremendous amount of potential.

Bonus Tip: Getting a Clear Understanding of Your Cash

There’s an old saying in accounting circles that when people focus on revenue, they’re just engaged in vanity. They’re just looking for an ego boost. What keeps them sane of course, is their profit.

Both of these are good, but nothing beats cash. According to this thinking, cash relates to the actual reality of your business.

If you agree, then you need to learn how to read the third most important document for your Amazon business: the cash flow statement. This statement monitors how much working capital flows in and out of your business during a period.

Cash flow is a specialized statement because the profit and loss statement and the balance sheet don’t give you a clear understanding of how much cash your business needs to operate. The good news is you don’t have to do this on a daily or even monthly basis

If you are an FBA merchant, a quarterly cash flow statement should be enough. FBA simply refers to your shipping inventory to Amazon’s fulfillment infrastructure, and Amazon takes care of everything else. You pay a fee to Amazon to not only store your stuff but also to ship it out to customers.

With FBM, you’re doing the fulfillment yourself. This is called Fulfillment by Merchant. Since you are going to have to deal with the cash flow directly, you would have to do this on a month-to-month basis, at the very least. In fact, a lot of FBMs keep track of their cash flow statement on a weekly basis.

A cash flow statement is just a balance sheet with a new piece of information added. Instead of just listing out your assets, you also have to include how much cash you have and under which account.

For example, if you have a savings account and a checking account, you’re going to have to break that down— cash in checking and cash in savings. They have to have their entry in your balance sheet, but everything else is pretty much a standard balance sheet calculation.

You list out the items on the left column and then sum them up. Then, you list out the items on the right column, and you calculate owner equity and label it as net income.

How do you make decisions from your cash flow statement?

Well, your cash flow impacts three key areas: finance, investing, and operations. Let’s explore below:

FINANCE

Finance relates to borrowing cash and repaying obligations. For example, if you received a loan to stock up on your inventory, this amount is tracked as an outflow item in your cash flow statement

INVESTING

Investing relates to any selling and buying of assets that do not have anything to do with your inventory. Investing can include equipment and real estate property if you have a warehouse. All these are outflow items in your cash flow statement

OPERATIONS

Operations relate to sales income from Amazon as well as how much you have to pay not only your ultimate supplier but also the freight forwarder that handled the shipping of your inventory in the first place. You should also factor in income tax as part of this outflow section.

It’s Magic

Once you’ve lined up and added together or your inflows, you then deduct the total sum of the outflows you have. In your cash flow statement, you can break down all the outflows in the three general headings above: finance, investing, and operations.

The amount of money left over, of course, is the cash balance for the period. This information helps you keep track of how much cash you have. It also helps you plan inventory purchases, possible new advertising campaigns, and other strategic decisions.

Disclaimer: The above information is made available on a good faith basis and is intended only for general education. The article should not be construed as tax or legal advice. We recommend getting in touch with a duly certified tax professional or CPA to assist with any topics raised by this article.

(Hero image by Freepik)