More than ever e-commerce sellers must understand whether they are affected by state sales tax. In particular, New York State has strict rules on conducting proper registration and filing for sales tax. Let’s take a look at the New York Sales Tax for Amazon Sellers.

To determine whether NYS Sales Tax is applicable to you, as an Amazon seller, you must first determine whether you have a “nexus” in New York. Nexus is the determining factor of whether an out-of-state business selling products into a state is liable for collecting sales or use tax on sales into the state.

Do you have a sales tax nexus in New York?

Another way of saying “Sales Tax Nexus” is having a “significant presence” in a particular state.

You have a Sales Tax Nexus if you are an Amazon seller with any of the following in New York:

An office or place of business;

An employee present in the state for more than 2 days per year;

Goods in a warehouse;

Ownership of real or personal property;

Delivery of merchandise in New York in vehicles owned by the taxpayer; or

Independent contractors or other representatives in New York.

The New York Department of Taxation and Finance (New York’s taxing authority) defines what constitutes a Sales Tax Nexus here.

Registration for a sales tax permit in New York

Before making taxable sales, register and obtain a Certificate of Authority from the NY tax department.

Sellers can apply online through the NYS License Center. They must register/apply at least 20 days before they operate their business in NY.

Collecting Sales Tax

The point of delivery determines the rate of the sales tax per transaction.

The final tax rate is the tax rate in effect in the state where the delivery occurs, plus the local tax rate, and district/transportation rate if applicable.

Certain exempt purchases (e.g., the buyer provides an exemption certificate within 90 days of the purchase), do not require sales tax collection.

Filing sales tax returns in New York

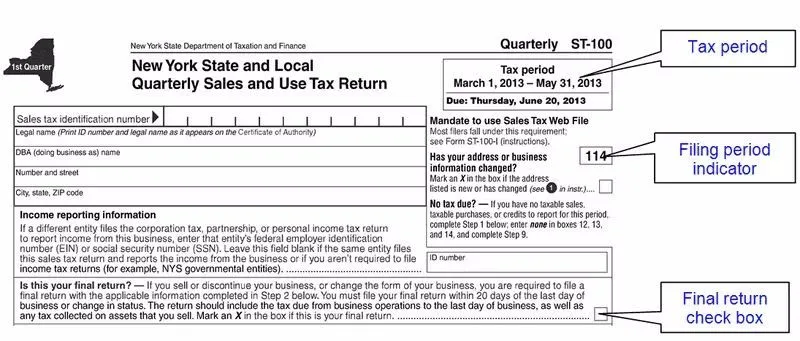

When you register as a vendor in New York, you will be classified as a quarterly filer unless you meet the specific conditions for monthly or annual filing. Your sales tax payments and returns will be due on or before the 20th of the month following the reporting period.

New York requires Amazon Sellers to keep detailed records of all their sales for at least three years from the due date of the return or the date when the return is filed— whichever is later.

New York also requires Amazon Sellers to file online at the State’s Department of Taxation and Finance website.

Important Note on New York Sales Tax for Amazon Sellers:

New York is serious about sales tax evasion issues within its borders. Penalties and interests that are as high as 14.5% may be charged for late payment of sales tax. Additionally, a Certificate of Authority could be revoked or you can face criminal prosecution.

If you are a vendor and receive a notice from the State of New York Tax Department advising you of your outstanding tax liabilities, they may pursue collection or even enforce income execution to collect what you owe.

The State offers a Voluntary Disclosure and Compliance Program for vendors. Eligible vendors with a noncompliance history who voluntarily disclose and pay their outstanding liabilities will not be imposed with penalties or criminal charges. Qualified taxpayers are even eligible for a limited look-back period.

In Conclusion …

To sum it all up, vendors of taxable properties and services in the State of New York must apply for a Certificate of Authority, collect sales tax remit the taxes, and regularly file returns to avoid penalties or criminal charges.

Disclaimer: The above information is made available on a good faith basis and is intended only for general education. The article should not be construed as advice on tax or legal issues. We recommend getting in touch with a duly certified tax professional or CPA to assist with any topics raised by this article.