Let’s get one thing clear, when it comes to your Amazon 1099, you’re going to be in for a challenge. This form doesn’t match any other downloadable report from the same Amazon platform.

Sellers are often worried - Amazon submits the 1099 report submits to the IRS.

Fear not! We’ve written the following post to take all the guesswork out of your Amazon 1099 numbers. This article will help you:

Understand your IRS Amazon 1099-k Report.

Determine your gross revenues so it squares with the figures on your 1099-k Amazon report

Calculate all the expenses you’re charged at Amazon

Figure out any Amazon refund amounts

Gain a clearer understanding of how your biweekly Amazon payments are calculated

Understanding the Amazon 1099-k

The revenue figures you see on your Amazon 1099 report are the total of the following:

Sales of products

Credits for shipping

Promotional rebates

Sales tax collected

To track down these numbers, you simply need to download your account’s date range transactions report.

To access the transactions report, follow these steps:

-

Click Payments on your Reports tab

-

Select Date Range Reports on your Payments page

-

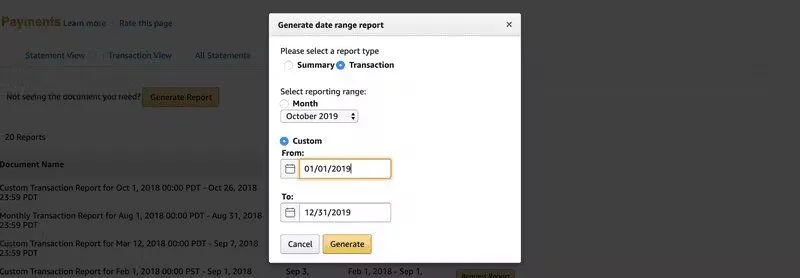

Select Generate Report on your Date Range Reports section

-

Pick Transaction among the options in the drop-down list under Select Report Type

-

Under Select Reporting Range choose Custom and select a time span of January 1 - December 31 for the applicable year.

-

Click on the Generate button

7. Download the resulting report.

After you have a copy of the report, filter it using Type. Make sure to include only Order transactions.

Once you have added the four columns listed earlier, the figures should mirror the 1099-k numbers reported by Amazon.

For the life of me, I am still confused about why Amazon did not make the transactions report and 1099 amounts easier to access.

Amazon 1099-k Figures and Bookkeeping

Amazon reports your 1099 to the IRS, so it is extremely important that your 1099 figures from Amazon match the revenue you report to the IRS.

Additionally, you don’t want to end up paying more money than you have to in taxes.

To ensure this does not happen, we highly recommend you need to use some sort of bookkeeping tool. We created taxomate to automatically send all your financial accounting information (including data for 1099) to QuickBooks or Xero.

Whether you go with Xero or Quickbooks Online, the process I’m going to describe below is fairly similar between those two platforms. If you would like to see a detailed comparison of the two accounting software check out our article on the topic.

Amazon 1099 by Example

To get started, create or link your bank account to QuickBooks or Xero. This bank account will represent the accrual account credited when your Amazon store makes a sale. I dubbed this account the “Amazon Payment Account” on my accounting software (feel free to name it however you would like).

It’s very important to note that the system that I’ve described below considers Amazon income to be earned once the customer completes the transaction. This is very important because the alternative way of accounting for this is to calculate income when Amazon actually distributes cash. This way, we’re able to get the exact same revenue numbers that Amazon reports to the IRS using the 1099-k form.

Entering into QuickBooks / Xero

All the numbers that you need are going to be listed by the transactions report you downloaded from Amazon earlier.

To get started, create a Sales Receipt or Journal Entry in your accounting software for each settlement period with the customer “Amazon Marketplace Place”.

The revenue amounts should total the numbers in your 1099. The income figures you may see include:

Collected sales taxes

Promotional rebates

Credits for gift wrapping

Credits for shipping

Product sales.

Expense figures will not show up on your Amazon 1099-k but will show up in your transaction report. The expenses figures you may see include:

FBA fees

Amazon selling fees

Advertising Fees

Any other fees listed in the transaction report.

The deposit represented by the Sales Receipt or Journal Entry is accounted for in the Amazon Payment account, the accrual account. This allows for easy reconciliation with the bank deposit.

Once you save the receipt or entry, you can then match them over your bank deposits.

This article should have given you enough information to provide you with an idea of how to reconcile your 1099 with Amazon’s reports!

Disclaimer: The above information is made available on a good faith basis and is intended only for general education. The article should not be construed as tax or legal advice. We recommend getting in touch with a duly certified tax professional or CPA to assist with any topics raised by this article.